Which of the Following Statements About Irr Is Not True

For a project to be accepted IRR should be more than its cost of capital. QN221 20479 Which one of the following statements about IRR is NOT true.

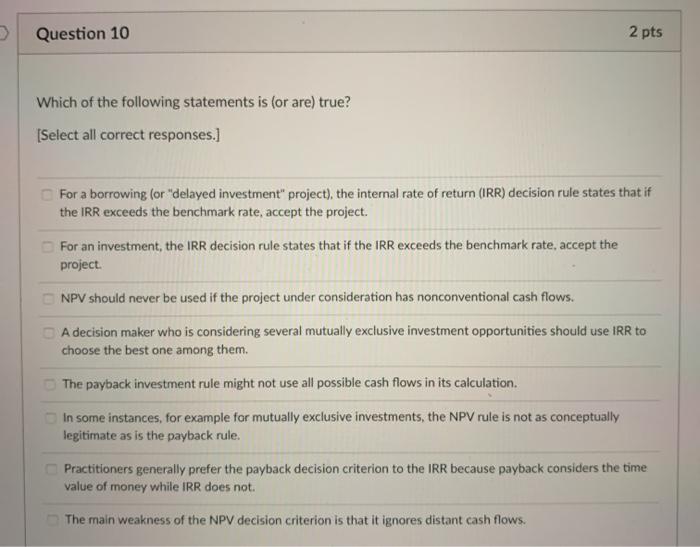

Solved Question 10 2 Pts Which Of The Following Statements Chegg Com

The IRR is a discounted cash flow method.

. The IRR is an expected rate of return. Which one of the following statements about IRR is NOT true. The IRR is a discounted cash flow method.

The IRR is the discount rate that makes the NPV greater than zero. The IRR is a discounted cash flow method. Chapter 15 Multiple-choice questions.

Which of the following statements about IRR is NOT true. C The internal rate of return does not consider the time value of money. Which of the following statements is TRUE.

The accounting rate of return is measured as follows. IRR assumes reinvestment at the cost of capital. NPV assumes that cash flows are reinvested at the cost of capital of the firm.

The IRR is an expected rate of return. IRR is the rate at which the net present value is nil. - The IRR is a discounted cash flow method.

NPV and IRR yield the same ranking when evaluating projects. The IRR is the discount rate that makes the NPV greater than zero. The IRR is an expected rate of return.

The IRR is the. NPV identifies the value added to the firm if it accepts the capital budgeting project. A project may have multiple IRRs when the sign of the cash flow changes more than once.

Which one of the following statements about IRR is NOT true a The IRR is an from FIN 3403 at Florida International University. None of the above. For a project to be accepted IRR should be more than its cost of capital.

It is the discounted value of cash inflow minus the original. D A project could be rejected based on the IRR method while NPV method accepts it. The payback method accounts for the time value of money.

The internal rate of return is the rate at which the net present value of a project is equal to zero. D The internal rate of return. The IRR is a discounted cash flow method.

Natt Ltd is considering undertaking a project that would yield annual profits after depreciation of 68000 for 5 years. B The discount rate exceeds the cost of capital. The IRR is a discounted cash flow method.

The IRR is the discount rate that makes the NPV greater than zero. A The IRR must be greater than 0. The IRR is the discount rate that makes the NPV greater than zero.

If the cash flow stream has one or more cash outflows interspersed with cash inflows there can be multiple IRRs. None of the above. Answer of Which of the following is a true statement about IRR.

If the cash flow stream has one or more cash outflows interspersed with cash inflows there can be multiple IRRs. IRR is the discount rate when NPV is equal to zero. Which of the following statements about IRR and NPV is incorrect.

The IRR is the interest rate that sets the present value of a projects cash inflows equal to the present value of the projects cost. Which is not a correct about internal rate of return. Q7 Which of the following statements is not true.

A The IRR is an expected rate of return. Which of the following statements regarding internal rate of return is correct. The IRR is a discounted cash flow method.

Which one of the following statements about IRR is NOT true. The IRR is the discount rate that makes the NPV greater than zero. Which one of the following statements about IRR is NOT true.

The cash inflows and outflows associated with a project are as follows. The IRR is the discount rate that makes the NPV greater than zero. ORDER THIS PAPER NOW AND GET QUALITY WORK WITHIN NO TIME.

Answer of Which of the following statements is TRUE. The initial outlay of the project would be. The IRR is the discount rate that makes the NPV greater than zero.

C The IRR is a type of discounted cash flow method. Which one of the following statements about IRR is NOT true. It is preferable for the calculated IRR of a project to be below bank interest rates.

The IRR is the interest rate that sets the NPV equal to zero. IRR is the discount rate when NPV is greater than zero. C The profitability index equals 1.

Which one of the following statements about IRR is NOT true. There is always 1 IRR for a project. IRR assumes reinvestment at the IRR rate and is the discount rate when NPV is equal to zero.

- None of these. IRR does not account for the size of a project. - The IRR is an expected rate of return.

Add answer 5 pts. B The IRR is the discount rate that makes the NPV greater than zero. Which one of the following statements about IRR is NOT true.

IRR is a constrained optimization method. - The IRR is the discount rate that makes the NPV greater than zero. D Accepting the project has an indeterminate effect on shareholders.

The IRR is an expected rate of return. The internal rate of return is the rate at which the net present value of a project is equal to zero. Which of the following statements about IRR is NOT true.

None of the above. The IRR is an expected rate of return. Which of the following is not true regarding the IRR.

The IRR of every project is based on it achieving a Net Present Value of zero. IRR is a reliable measure for. Discounted cash flows do not usually take into account the time value of money.

NPV identifies the value added to the firm if it accepts the capital budgeting project. IRR provides an indication of the rate of return for the firm on a given project. The correct answer is a.

IRR provides an indication of the rate of return for the firm on a given project.

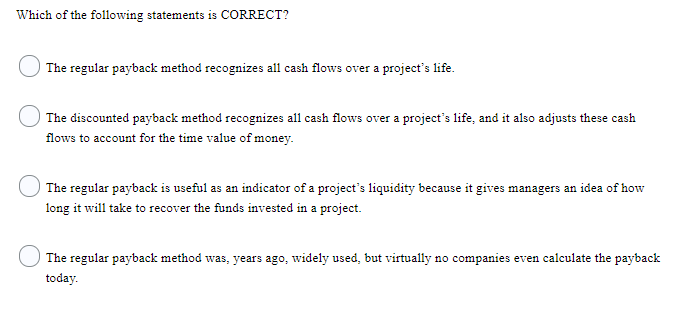

Solved Which Of The Following Statements Is Correct The Chegg Com

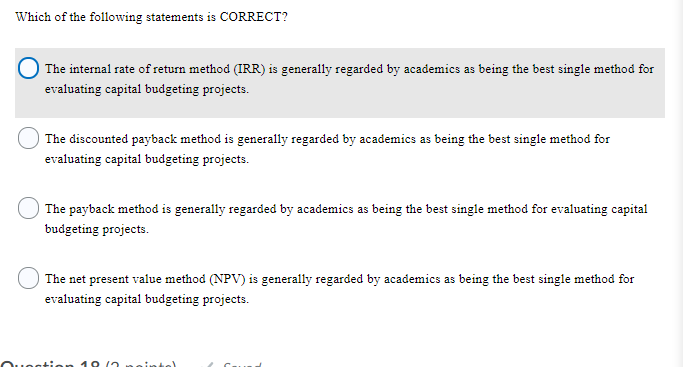

Solved Which Of The Following Statements Is Correct The Chegg Com

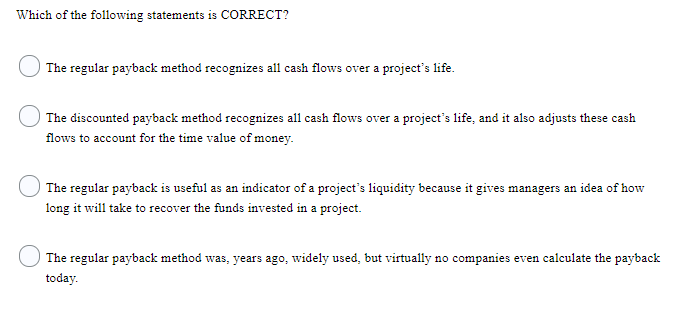

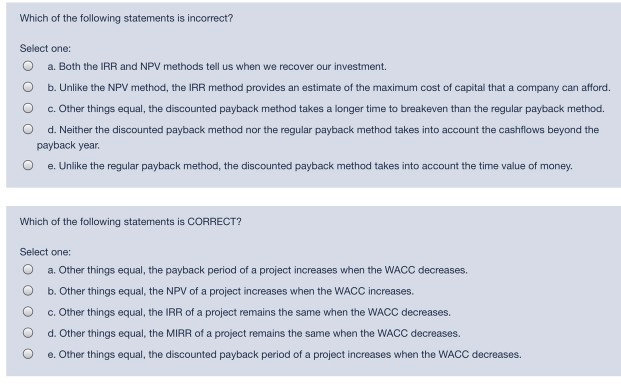

Solved Which Of The Following Statements Is Incorrect Chegg Com

No comments for "Which of the Following Statements About Irr Is Not True"

Post a Comment